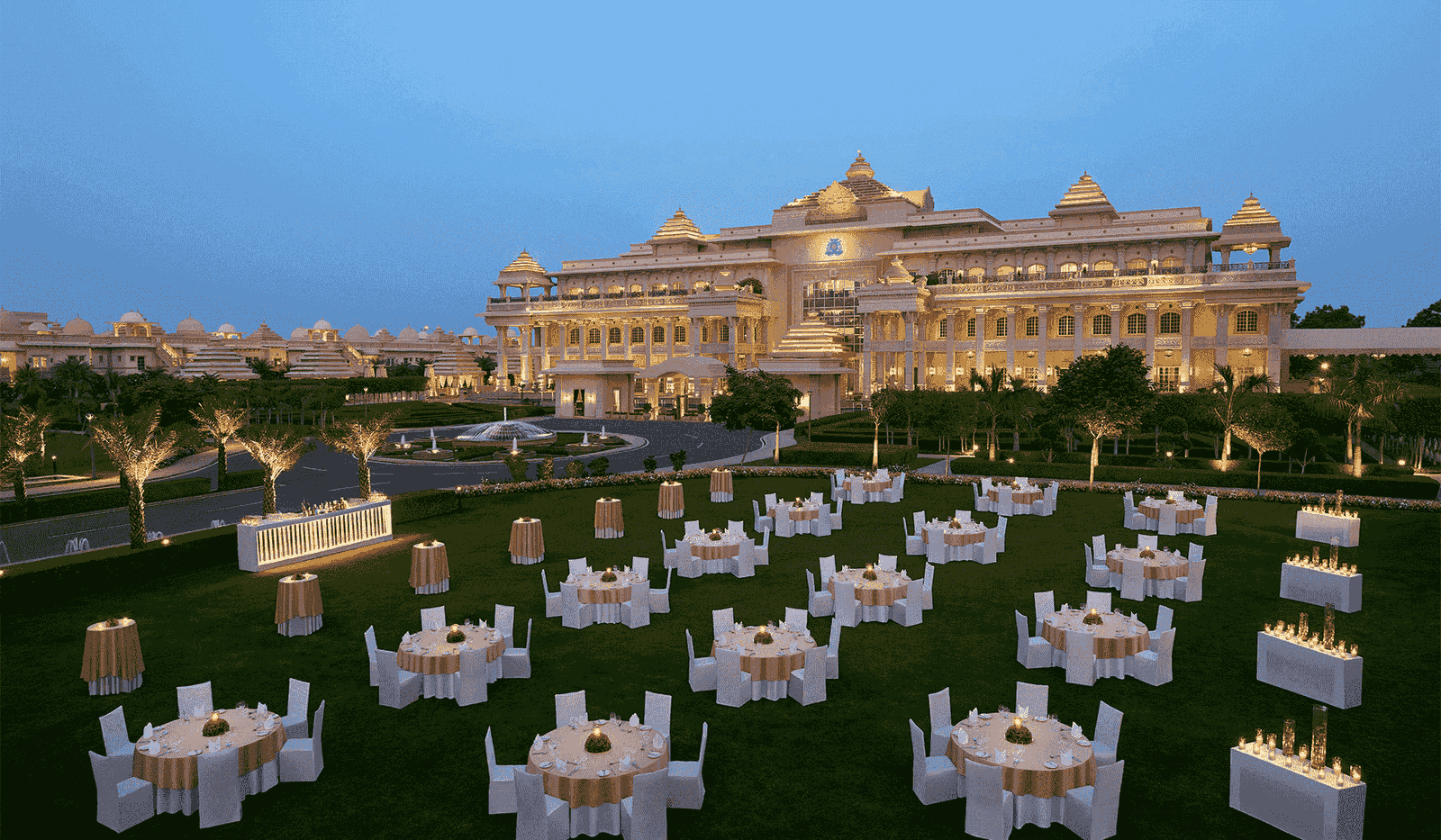

Divya Delhi: ITC Hotels shares rose over 3% to a record high of Rs 246 on the BSE after the business reported a 54% YoY increase in net profit for the first quarter of FY26. Investor sentiment was boosted by Q1FY26's net profit of Rs 133 crore, up from Rs 87 crore last year. The quarter's operating revenue climbed 15.5% to Rs 816 crore from Rs 706 crore in Q1FY25. Profit after tax (PAT) fell 48% from Rs 257 crore in Q4FY25. Revenue fell 23% quarter-on-quarter to Rs 1,061 crore in the March quarter, lowering PAT. Operating expenses were Rs 675 crore, up 13% YoY from Rs 596 crore in Q1FY25 and down 10% from Rs 750 crore in Q4FY25. Benefits, food, and financing were major expenses. The main hotel business earned Rs 801 crore in Q1FY26, up from Rs 690 crore in Q1FY25 but down from Rs 1,043 crore in Q4FY25. Realty did not earn revenue in the quarter. ITC Hotels stated that its Colombo, Sri Lanka, real estate development will only be recorded after the branded residences are sold. Global stockbroker Jefferies maintained a ‘Buy’ recommendation on ITC Hotels, raising its target price to Rs 270 from Rs 240, an 18% increase. With 16% YoY top-line revenue growth and 19% Q1 EBITDA growth, the business applauded the hotel chain's operational success. Cash reserves of Rs 1,900 crore at FY25-end helped boost treasury income and PAT by 54%, according to Jefferies. ITC Hotels reported strong RevPAR and a 9% increase in average room prices despite a dismal May for the hospitality sector.

- Education(148)

- India(771)

- Entertainment(399)

- Sports(272)

- Business(226)

- Bollywood Hollywood(95)

- International(196)

- Life & Style(91)

- Opinion(139)

- Educational(5)

- Crime(7)

- Technical(6)

- World(18)